Category: About Forex Trading

How you can make money with forex

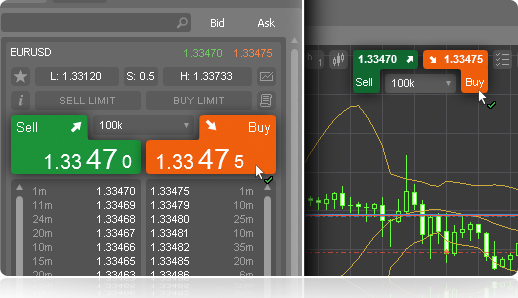

To make money with forex, it is a bit of a gamble: the trader must predict that a currency will either rise in value or fall in value against another currency. So he buys the currency he feels will gain value and simultaneously sells the one he feels will lose value against the currency he has bought. After some time, if the trade plays out as he has predicted, he re-exchanges the two currencies in view and closes the trade.

Traders can buy different amounts of currency to trade. In forex, the size of the currency a trader purchases is measured in lots.

– 1 lot is worth $100,000.

– 1 mini-lot (one-tenth of a lot) is worth $10,000.

– 1 micro-lot (one-tenth of a mini-lot or one-thousandth of a lot) is worth $1,000.

The trader can purchase any contract size depending on the amount of money he has available to him. Forex is a leveraged market. Many traders may not have up to $100,000 to trade at once, and so a system has been developed to get the brokers to match the trader’s equity. So all the trader needs to come up with is a small fraction of the trading amount as collateral for the trade. If the trade ends up a winner, the broker’s equity is returned on closing the trade and the trader keeps the balance. If the trade loses, the trader’s equity is reduced by the loss amount. If the loss in an active trade threatens the broker’s equity, an instruction is sent to the trader to put in more money or the trade is closed automatically (margin call).

The process of opening and closing trades in this manner is repeated several times a day (intraday traders or scalpers) or week/month (position and swing traders). The frequency of trading is determined by the trader’s trading style.

Forex Trading: What is it all about?

If you ever wanted to travel abroad, or you have received a remittance of foreign currency from a relation or friend living abroad or perhaps do some foreign business, you would have at one time or another had cause to visit the Bureau de Change operators to convert your local currency to foreign currency or convert foreign currency to local currency. You would also notice the following:

a) The rate at which local currency is converted to foreign currency is slightly lower than the rate of converting foreign currency to local currency.

b) These rates are usually not constant. They could be higher or lower depending on the time of the year and some economic factors.

c) Certain factors will affect the exchange rates in different ways. Some factors may cause rates to go up and some may cause them to go down.

Online forex trading involves the same processes and principles used in offline currency exchange, but with some subtle differences. The process is online, and this time, it is not just you and the exchanger (in this case, the dealer/broker), but you against the entire forex market participants located all over the globe.

In online forex trading, the trader is not just looking to exchange one currency for another, but is looking to profit from the change in exchange rates that occur every minute, hour, day, week, month or year, depending on how long the trader wants to stay in the market and how much gain he wants to make.

This in a nutshell, is what online forex trading is all about: profiting from the change in the rate of exchange of one currency to another in the globalized currency market. So get your computer ready (make sure it’s fast enough and that you don’t need a virus removal!) and start making some money with Forex!